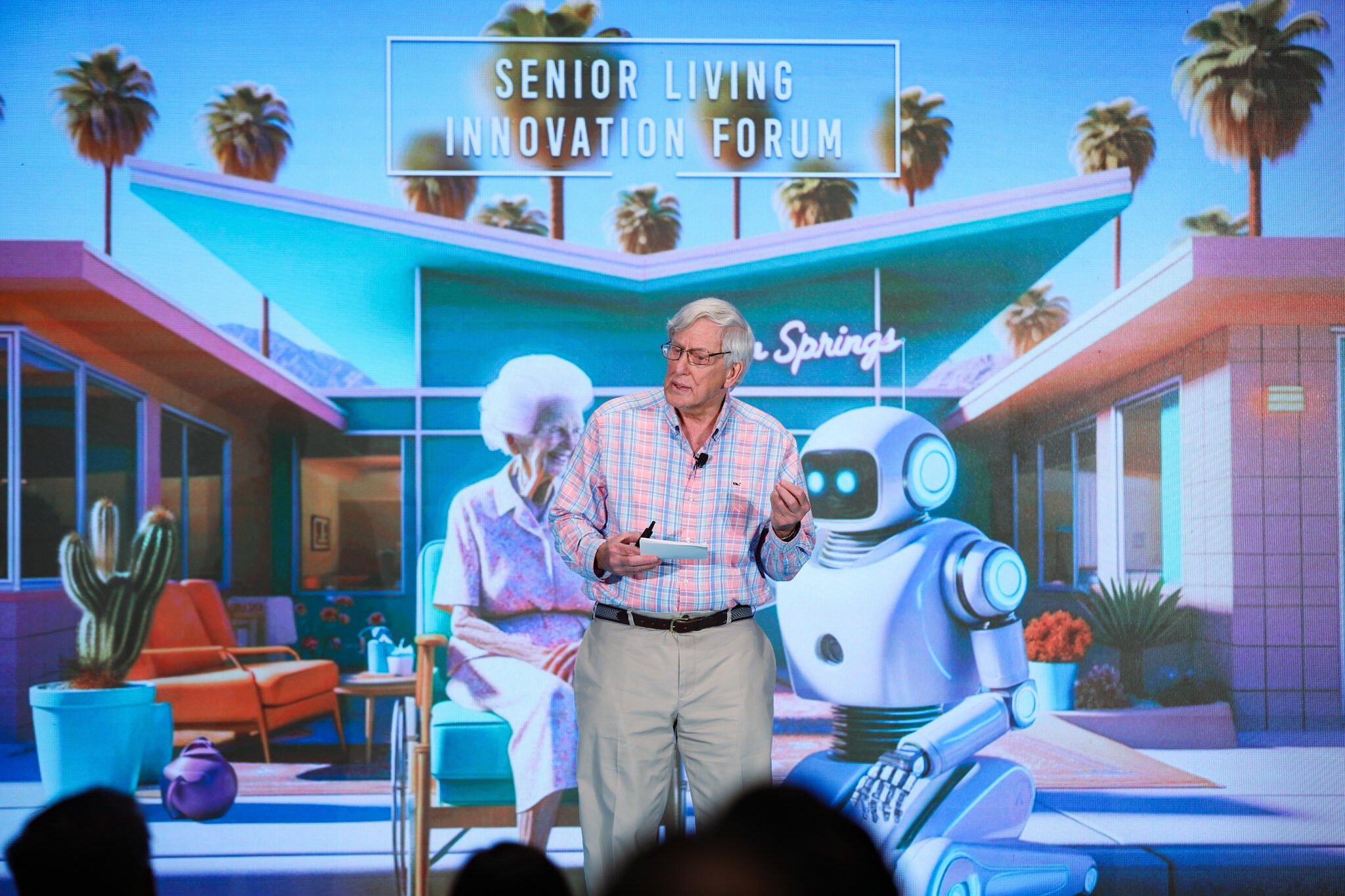

When Bob Kramer spoke at SLIF in 2021, he questioned whether the industry was bold enough to meet the challenges it was facing. A year later, he proclaimed that we’re at the dawn of a third generation of senior living, one defined by evolving ideas about aging and retirement. Returning to the stage at SLIF last month in Palm Springs, California, he unpacked those ideas even further, proposing a new model for the industry’s future.

Kramer, the co-founder and strategic advisor at NIC and principal of Nexus Insights, also issued a warning. The industry is primed for disruption, he said: if it doesn’t meet its customers where they are, others will. At the same time, he believes immense opportunity lies ahead, for both care-driven and active adult models. To figure out how to leverage this opportunity, he proposed that providers ask themselves six questions.

What age are we talking about?

Kramer explained that while the first baby boomers will turn 80 in 2026, the impending wave of new customers for private-pay senior living facilities likely won’t come until 2029 because the average age in these communities is 83 to 85. Generally coming from higher income brackets, these customers have had better access to healthcare throughout their lives and, therefore, have less need for care-driven services until later in their lives.

“The reality is that the traditional customer for private pay senior living is, comparatively speaking, healthier,” Kramer said. “That customer is, in many cases, 85 going on 65, whereas in a different zip code you'll have customers who are 65 going on 85.” This naturally raises his second question:

What’s the affordability of the product—and to whom?

Despite popular narratives about the massive wealth transfer that will come with Boomers passing down their assets to their children, Kramer argued that only one group has enjoyed wealth appreciation at a rate significantly higher than inflation or industry rate increases over the last five years: the top ten percent, who have seen their wealth grow by more than 40%.

“This is really important,” he said. “The forgotten middle has just gotten a lot bigger. The ability of younger Gen X-ers and millennials to contribute to their parents’ care costs is nowhere near what it was for the Boomers.”

These trends have given rise to a raft of new companies seeking to disrupt the sector by targeting that top decile. “Their whole focus is coming after the top 10% (this group expands when you tap home equity) who don't want to move into our communities, and offering them a model that they will want,” Kramer said. Accordingly, he predicted that a new model of provider will emerge: longevity clubs.

“I would posit that what the country club was to the Greatest Generation in the ‘70s, ‘80s, and ‘90s, longevity clubs will be to the boomers in the ‘30s, ‘40s, and ‘50s. Rather than golf and tennis, it’s gonna be about longevity. It's not gonna be just about relaxation and leisure.”

What stage are we on?

To illustrate what stage the industry is in right now, Kramer compared it to commercial theater. A production used to open in a regional venue, work out the kinks, and get some (hopefully good) reviews before it made the leap to Broadway. Senior living, he argued, has spent the last few decades in that regional theater, establishing its bona fides and persuading investors that it’s ready for the big leagues. Now it’s finally on Broadway: a massive sector and asset class with the respect and scrutiny that follow.

“What does it mean to arrive on the main stage?” Kramer asked. “The critics are a bear. The lights are intense, the spotlight's always on, and there's no margin for error. Welcome to senior living in the last couple of years.”

Faced with all these mounting pressures—attention from the press, congressional hearings, changing regulations—the industry has no choice but to adapt to its new status. “Those that don’t,” Kramer said, “Won’t survive.”

What’s the opportunity—and for whom?

Popular perspectives about retirement are shifting. Whereas older generations have seen it as a time for rest and relaxation—what Kramer described as a passive view of retirement—the new generation views it differently. “It’s an active view,” he said. “It’s a positive view. It’s what I call a next-stage view, not an end-stage view.”

What do you get when you combine enormous demand for senior living, skyrocketing costs, dissatisfaction with the traditional product, and what Kramer described as the “hubris” of some industry leaders who think the status quo is just fine? “We’re ripe for disruption,” he said. “And we'll either adjust or we'll get disrupted right out of business.”

What’s our current value proposition?

One reason the industry is ripe for disruption is that its current value proposition is geared towards that end-stage perspective of senior living. “It’s what I would call an avoidance product that people dread to move into,” Kramer said. We'll keep you clean, safe, dry, fed, and toileted till you die.”

Suffice it to say, this is not the most compelling value proposition for the next generation of senior living customers. “The Greatest Generation—my parents, my in-laws—they were just grateful to have those additional years of what I call accidental longevity,” he argued. “If we're not offering purposeful longevity, boomers are going to look for products and settings that do.”

What can replace it?

The answer is a business model focused on next-stage living, in which communities provide the sense of purpose their residents are seeking. As Kramer put it, it’s not about adding years to their lives but adding life to their years. For providers, this means identifying what their customers have to offer, what they want to learn, what talents they possess, and what they want to achieve in the coming months and years—and then helping them achieve it.

By helping residents feel like contributors rather than takers, the industry will give them a needed sense of purpose and all the health benefits that follow. “Not only will they live longer, on average seven and a half years, but they'll be healthier during those last seven and a half years,” Kramer said.

As he rounded out his talk, Kramer acknowledged that his vision for the industry is a bold one. Still, he believes it’s just what’s needed to meet the challenges ahead. “It offers an aspirational vision and an opportunity for senior living and aging services to reinvent itself,” he concluded. “That, to me, is a future with promise, one that can really meet the huge demand and need that's out there.”

Posted by

SLIF heads to Carlsbad!

The One of a Kind Retreat for Senior Housing Leaders.

May 31 - June 2, 2026 | Carlsbad, CA

Learn More

Comments