As he opened his presentation at the Senior Living Innovation Forum in Napa, California, Dwayne J. Clark warned the audience that they were in for a provocative conversation. “The content may not be politically correct,” said the Founder and CEO of Aegis Living. “But my purpose is to help you.”

He delivered on both promises, offering controversial but deeply informed insights from his decades in the industry. From hiring tips to revenue-optimization techniques, his talk gave the audience a wide-ranging look at why operators fail—and what steps they can take to succeed.

Stop Marrying Your Cousin

Clark’s first words of advice for his fellow operators? “Stop marrying your cousin”.

…He was speaking metaphorically, of course, describing the tendency to hire from within the senior living industry. “Brookdale hires from Sunrise, Sunrise hires from Atria, Atria hires from Leisure Care, Leisure Care hires from Oakmont,” he said. “It goes on and on and on and on.”

He acknowledged that the practice seems sensible enough, given senior living’s explosive growth and the accompanying pressure to hire talent with experience. At the same time, he staunchly advocated bucking the trend, encouraging his peers to recruit from outside the industry. At Aegis, he noted, 86% of the company’s general managers do not come from within—they’re either home-grown or joined from another field.

Aegis’s approach is driven by a philosophy called, Weaving the Quilt. “The concept of the weaving of the quilt is that we look at the companies that we hire from, as opposed to the person,” Clark explained. “And we say, well, what can that company or culture teach us?”

The Aegis quilt is a patchwork of multi-billion-dollar companies spanning numerous industries: Microsoft, Four Seasons, Starbucks, Ritz Carlton, Amazon, Hilton, Nordstrom, BlackRock, Louis Vuitton, and Target.

“Every time we get a piece of the quilt, it allows us to build our culture, to build our knowledge, to build our intellect, to build our policies, to build our procedures, to build our training,” Clark said. “If you don't get out of the habit of marrying your cousin, your company won't go anywhere, and you'll fail. I promise you.”

Rethinking Compensation

Equally important is ensuring that compensation for executive directors is competitive. In Clark’s view, that means base salaries should start quite a bit higher than current industry standards. “We can't hire a capable person to run a 70-unit building for under $180,000,” he explained. “That's our starting rate. If you're a superstar in our company—you exceed the budget and expectations—my expectation is that a general manager is gonna make over $300,000.”

While this may raise eyebrows, Clark stressed the sheer scale of the job. “How are we going to hire people to run a healthcare center, run a restaurant, run a hotel, run a cruise ship for $120,000?” he asked. “You can't hire competent people in a 3.5% unemployment market for $120,000. You just can’t.”

He also stressed that when you hire good people, they hire good people: the investment in quality talent pays off in innumerable ways. In addition, one key part of Aegis’s onboarding process for new general managers is a 100-day training period.

During this window, they tour the company’s other locations, gaining a sense of their strengths and developing a crucial support system in the form of their colleagues. “They may have 6, 8, 10 peers by the time they're done with 100 days,” Clark said. “So instead of calling their boss and going, ‘God, I just don't understand this,’ and being afraid to ask the stupid questions, they have peers that they can ask these questions.”

“This, for us, was a game changer,” he added. “Absolute game changer.”

Getting Rid of Loyal Duds

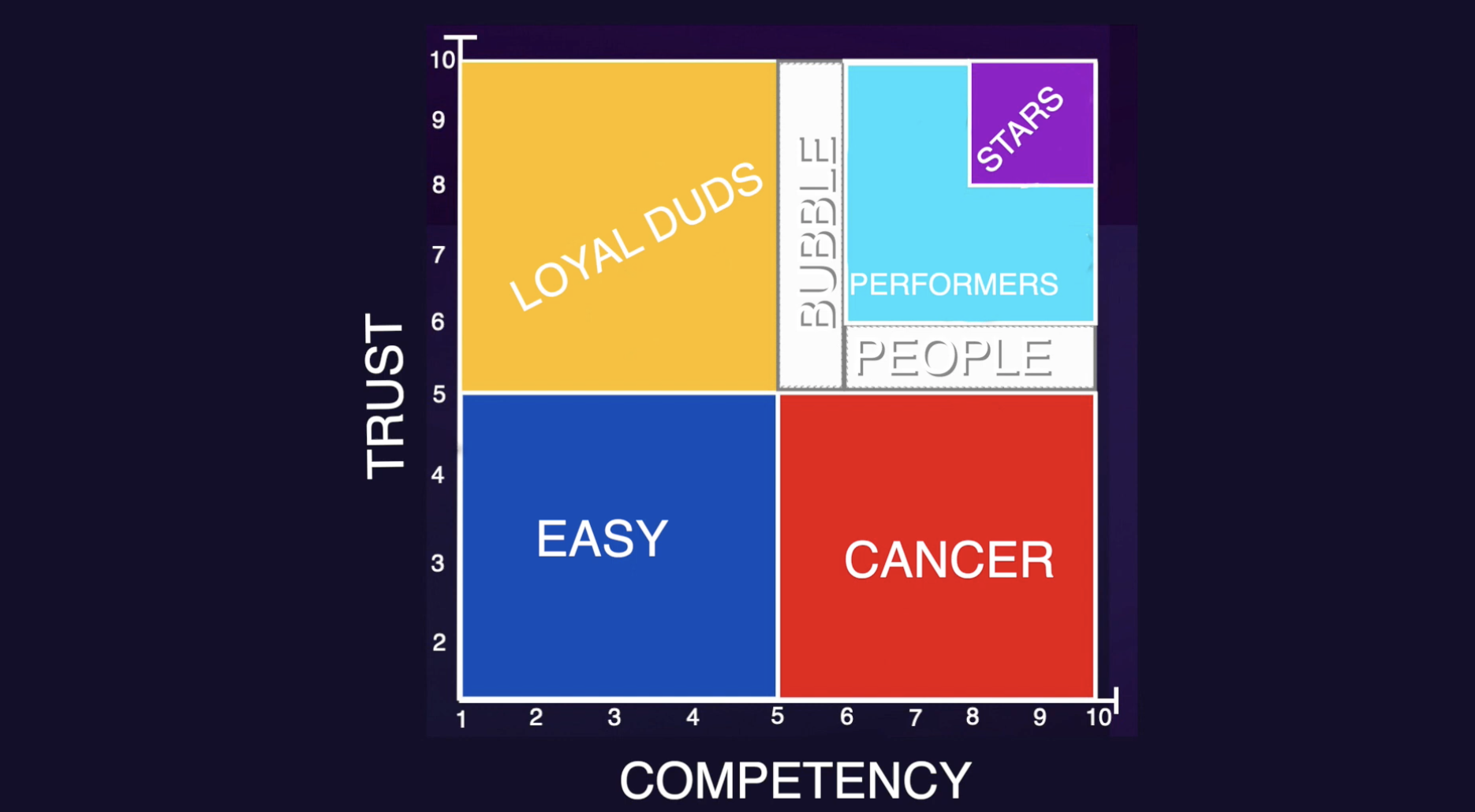

Taking cues from his friends in the Navy SEALs, Clark uses a grid diagram to evaluate employee value, identifying who is essential to a company’s success and who will risk its failure. The grid’s X-axis measures competency, while its Y-axis measures trust.

In the southwest quadrant (low competency, low trust) reside what Clark calls the “Easys”—because it’s easy to let them go.

In the northwest quadrant (low competency, high trust) are the “Loyal Duds,” who always show up and make great teammates but just aren’t very good at their jobs. “These are the people that cause us to fail,” Clark cautioned. “If you don't realize that and move on, you're gonna fail.”

In the southeast quadrant are the “Cancers,” who are highly competent but not trustworthy at all. “They not only meet the budget, they exceed the budget; their census is high, and they would stab you with a steak knife once you turn your back,” Clark explained. “They ruin your culture.” As with the Loyal Duds, letting them go is vital to success.

Finally, the northeast quadrant contains (in ascending order) the “Bubble People,” who are highly competent but still have some trust to be developed; the “Solid Performers,” whose title speaks for itself; and the “Stars,” who exceed all competency and trust expectations.

“This simple tool can help you succeed,” Clark said of the diagram. “Use it.”

“Big Does Nothing”

Elsewhere in his presentation, Clark argued that ASHA’s annual ranking of the 50 largest operators in the US is the “biggest nothing burger.” In his view, the list measures entirely the wrong things.

“Big does not mean successful,” he said. “Big does not mean profitable. Big does not mean a good culture. Big does nothing. In fact, my personal opinion is that ‘big’ is a cancer for our industry.”

Clark doesn’t want to be the biggest operator; he wants to be the most profitable. Indeed, Aegis offers compelling evidence that the latter is more than possible without the former. The company’s NOI goal per unit for its new properties, he said, is $6,000—well over the industry average of $2,360.

What does that mean for Aegis’s valuations? “If I'm looking at $6,000 on a 100-unit building, that's $7.2 million,” Clark explained. “Let's say our cap is a little bit more favorable: five and a half. That's $131 million.”

The industry average is $47 million.

This is an essential part of Aegis’s strategy, and it all boils down to the operator’s focus on quality over quantity. “I don't have to have 150 buildings to be profitable, I just have to have one that kicks butt,” Clark said. “I don't have to be big. I just have to be great. And I'd rather be great than big.”

Naturally, it helps that Aegis owns the majority of its real estate, and that most of its 300 private investors are Clark’s friends. “Their combined net worth is north of $30 billion; when we go to raise $30, $40, $50 million, it's done in a week,” he said. As a result, the company doesn’t suffer from the misaligned incentives that can arise with institutional investors pursuing growth at all costs. “We don't have to rely on private equity, foreign investors, or REITs, or anything else. Our interests are aligned.”

The Problem with Levels of Care

In one of the more provocative sections of his talk, Clark argued that operators assessing costs by levels of care may be missing out on millions of dollars. Why? Because care staff—whose compassion is essential to their work—are disincentivized from elevating residents to higher levels of care when circumstances require it. Rather than saddle their patients with higher charges, they instead keep them at the highest point in their existing level.

“They're like, ‘Oh, let's just leave them right at the top of level one,’” Clark explained. “So by the time they get into level two, they're at the top of level two.”

Clark’s team at Aegis used to regularly conduct physical assessments of residents, ensuring that they were at the appropriate care levels. This practice became less frequent with the advent of electronic care records. Earlier this year, he asked his team to dispatch nursing staff for six weeks to see if the company was failing to capture any care. As it turned out, the answer was yes.

“By the time we were done with our buildings, we found $20 million on uncharged care,” Clark said. By being aggressive in some cases and backing off some of its rates in others, Aegis ultimately made up $15 million. “The census dropped one percent. For $15 million cash, the census can drop one percent.”

Running Towards What Works

Wrapping up his presentation, Clark left his fellow operators with a few words of wisdom given to him by one of the richest men on Earth. “When something works or something fails, it’s speed to pivot,” Jeff Bezos told him this at a Vatican conference last year. “You run towards it if it works, and if it fails, you automatically eliminate it. Quickly!”

He also encouraged his peers to compare their companies not only against other operators but against businesses outside senior living entirely. Calling back to his opening advice, he once again stressed the importance of taking lessons (and talent) from those businesses as well. “You'll never get ahead if you keep marrying your cousin,” he concluded.

Posted by

SLIF heads to Carlsbad!

The One of a Kind Retreat for Senior Housing Leaders.

May 31 - June 2, 2026 | Carlsbad, CA

Learn More

.png)

Comments